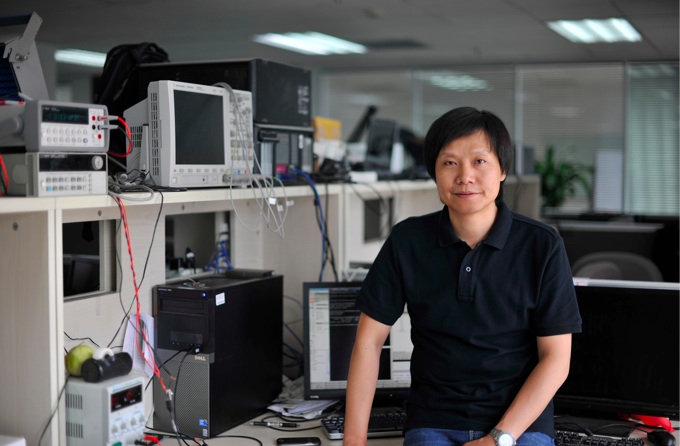

If you’re familiar with the Chinese tech scene, chances are you are also familiar with serial entrepreneur Lei Jun (pictured above). Recently, I had a chance to speak to him to learn more about his story as an entrepreneur, and about his latest venture, the disruptive phone-maker Xiaomi.

His journey goes back to 1992 when he joined software maker Kingsoft after graduating from Wuhan University. Kingsoft back then had just five or six people, but today the company has more than 3,000 employees. The company IPO’d in Hong Kong in 2007. While working at Kingsoft (HKG:3888), Lei Jun ran the site Joyo.com as a side project. Joyo started as a downloads website but later it became an online bookstore. Success followed, and Amazon subsequently acquired Joyo for a whopping $75 million in 2004 – now it’s today’s Amazon China, at Amazon.cn.

After Kingsoft went public, Lei Jun jumped full-time into angel investing which saw him invest in over 20 startups, including browser maker UCWeb, clothing e-tailerVancl, and payments service Lakala. All of his investments targeted companies in the mobile internet space. Lei Jun says that from 2007 to 2010, he has overseen over 70 funding rounds among his portfolio companies. And through his angel investing experience, Lei Jun became familiar with many local and international investors which he says have helped greatly in what would be his next venture – Xiaomi. He tells me:

We got to know a lot of investors and know what they like and don’t like. Through many co-investments opportunities, we have built trust among these investors. So when it came to investing in Xiaomi, things were a lot easier.

The birth of Xiaomi

Through his experience as an angel investor, Lei Jun firmly believes the mobile internet would be the next wave. And he believed in the importance of creating a channel, through hardware, in the mobile internet industry in China. “A phone as a channel,” he emphasizes. That idea gave birth to Xiaomi on April 6, 2010, over a year before its first smash-hit phone was revealed.

The Xiaomi Mi2, unveiled this summer and set to launch later this month.

Xiaomi was inspired by Apple, and Lei Jun pays great credit to Steve Jobs who he believes has shaped how the world uses phones and the mobile internet. Lei Jun saw the opportunity to create a smartphone tailored for China, a hardware company which can ride on the mobile internet wave. Lei Jun tells me that Xiaomi is built on three building blocks:

- E-commerce

- The openness of the Android platform and Xiaomi’s own MIUI skin

- Xiaomi’s fans

Regarding e-commerce, Lei Jun said Xiaomi could sell phones online without having physical stores, and that greatly reduces costs. The saved resources can be put into making better quality phones. Before Xiaomi launched the first-gen M1 phone, theattractive and versatile MIUI, an Android ROM, had already been in the works for a year and was already used by lots of keen Android tweakers who flashed it onto their phones. Lei Jun says that MIUI gained the recognition of Android fans across the world. Every Friday, there will be a new MIUI update to keep the Android ROM updated and fresh.

In the near future, Xiaomi aims to operate in different mobile operating systems, which may include Windows Phone,” said Lei Jun. But that won’t come too soon, he noted.

Feedback from fans about their perfect phone

Fans play a huge part in Xiaomi’s success. What Xiaomi has become today is largely due to fans’ feedback. For example, to test the upcoming Mi2 phone , Xiaomi invited over 1,200 fans to provide feedback which the company could then learn from. For example, some users of the first-gen phone, the Xiaomi M1, didn’t know that the SIM card has to be pushed into the slot until a “click” sound is heard. In its revamped Mi1S unveiled this summer as a cheaper alternative to the new Mi2, Xiaomi has added in instructions to inform users that the SIM has to be pushed in. Lei Jun says of the company’s enthusiastic fans:

Most of the fans have ideas about their perfect phone. But many of them can’t do it because building a phone is tough. So they would give us feedback about the features that they think should be included in our next model. And if we incorporated that in our new phone, they will share the good news with their friends.

Besides providing feedback voluntarily, Xiaomi fans also serve as an echo chamber for the phone-maker. Lei Jun says that word of mouth marketing is perhaps one of the company’s best promotional channels. He describes Xiaomi users as people who are usually banded in a group. If one person starts using a Xiaomi phone, his or her friends would most likely start using it too. And in that way, the word spreads. Fans’ enthusiasm over Xiaomi was apparent when we attended the recent Xiaomi Mi2 launch event in Beijing. Fans paid to be there (the ticket revenue was donated to charity) and wore orange to show that they are fans of Xiaomi.

Xiaomi has so far sold 3.52 million units of its outgoing M1 smartphone and aims to sell over 5 million total units by the end of this year with the Mi2 soon available – a bit later this month – in the market. Lei Jun says that his company has already hit more than $1 billion in revenue and is expected to hit $2 billion by the end of 2012. He also claims that Xiaomi is perhaps the fastest company to hit $1 billion in revenue in just a year of full operations.

Xiaomi is already a profitable company and is looking to expand to Taiwan and Hong Kong in the near future. When asked about markets outside of Greater China, Lei explains:

We’re not thinking about other markets like India or Indonesia, yet. We want to stay focused on the Chinese market first before expanding.

Lei Jun has also communicated to all his investors that Xiaomi has no plans to IPO within the first five years of operation. He explained that the focus right now should be on building a world-class phone and business model around Xiaomi, and not worry about the exit just yet. Plus, the recent Facebook IPO has shown the negative side of being a public company. Figures and statistics have to be revealed to investors and the public, which he believes will distract from the company’s focus on building a great product.

Will Xiaomi expand into tablets? The answer is “No,” says Lei. He feels that the tablet is a very competitive market already thanks to Apple’s iPad. He pointed to the recent iPhone 5 launch event whereby Apple’s CEO Tim Cook revealed that the iPad has cornered 68 percent of the tablet market share, with 91 percent of all tablet web traffic coming from the iPad.

When asked about Xiaomi’s greatest barrier, he explains that integrating software and hardware with a beautifully crafted mobile phone design is always the greatest challenge. To overcome that, Xiaomi’s core team members include people who previously worked at Motorola, Google, Microsoft, and Kingsoft. Plus, the team also has the network of contacts to attract more quality talent moving forward.

To date, Xiaomi has raised $347 million in total funds – the series C of $216 million was revealed this June – and the company is already profitable. But Lei Jun insists that Xiaomi still has a long way to go before it can become a world class product which can compete on the world stage. Things are looking great for Xiaomi and most people in the Chinese tech industry will agree that its selling-like-hot-cakes phone and mobile platform is a force to be reckoned with.

Source: TECHINASIA