Facebook won’t be throwing its advertising weight behind its new acquisition WhatsApp like it did with Instagram. But WhatsApp also won’t be focusing on rolling out the $1 a year subscription fee it currently charges in some countries. Instead, with the financial security Facebook brings, it will dedicate itself to growth.

Monetization was the big topic on today’s analyst call after Facebook announced it acquired WhatsApp for a jaw-dropping total of $19 billion. That’s $4 billion in cash and $12 billion in stock, and it reserved $3 billion in restricted stock units to retain the startup’s employees. But Facebook CEO Mark Zuckerberg, CFO David Ebersman, and WhatsApp CEO Jan Koum all said that won’t be a priority for the next few years. And when the time does come to monetize aggressively, it won’t be through ads.

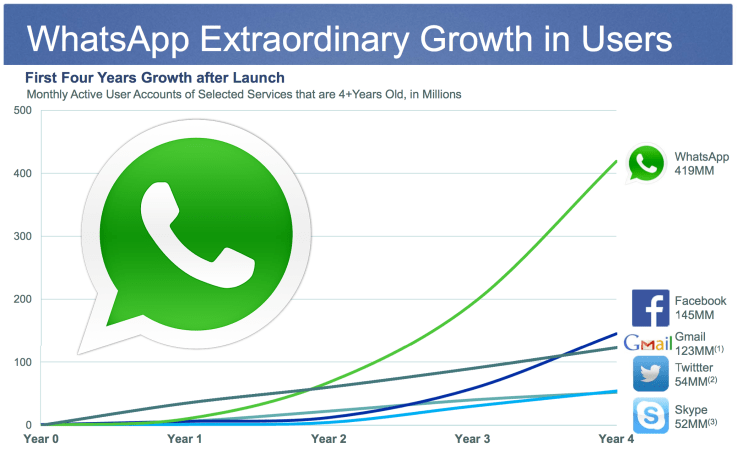

“Our explicit strategy for the next several years is to focus on growing and connecting everyone in the world,” Zuckerberg said. Currently, WhatsApp has a strong presence internationally with 450 million monthly users, but it’s a fragmented market with many competitors. Outpacing them right now is critical, Facebook’s CEO explained. ”Once we get to being a service with 1 billion, 2 billion, 3 billion people, there are many clear ways that we can monetize.”

Zuckerberg bluntly stated “I don’t personally think ads are the right way to monetize messaging.” Beyond WhatsApp, that could mean Facebook doesn’t plan to use ads to monetize its own Messenger app, either. That makes sense, as the highly personal and intimate nature of messaging would cause ads to stick out like sore thumbs.

The comments on the call reiterate a point that Koum has made in the past. In a 2012 blog post, he argued, “Advertising isn’t just the disruption of aesthetics, the insults to your intelligence and the interruption of your train of thought” — it also means that companies have to mine user data. (When asked about the age of WhatsApp’s users on the call, Ebersman couldn’t say, because the app doesn’t ask for that data.)

Koum made a similar commitment today in his post about the acquisition, writing, “You can still count on absolutely no ads interrupting your communication.”

Source: TechCrunch