Give a more longer term perspective of Economic trends and the Macroeconomic and Monetary Interdependence of the Global Economy. With the Background of this approach the blog will deal with the implications for Investment decisions. The author believes that China and the Asia Pacific Region are and will be the powerhouse for the global economic growth for years to come. It will also cover IT because of its momentum driver for economic growth.

Thursday, 23 January 2014

From theguardian: Chinese princelings in Caribbean offshore heavens II

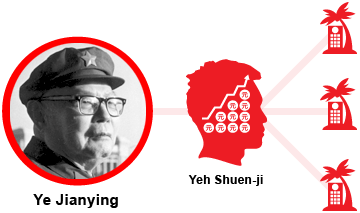

One of the Communist Party's "Eight Elders's" son

Fu Liang is the son of Peng Zhen, former mayor of Beijing and one of China's "eight elders". After a career in the rail industry, he shifted to a role in the leisure sector, as an investor in yacht clubs and golf courses.

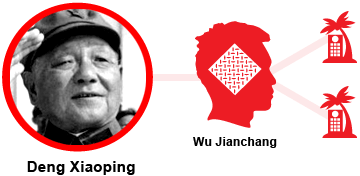

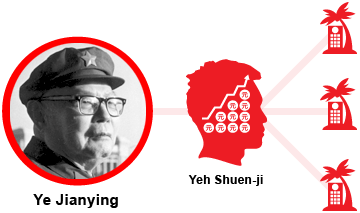

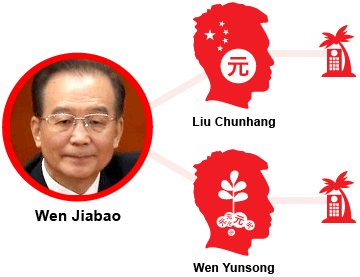

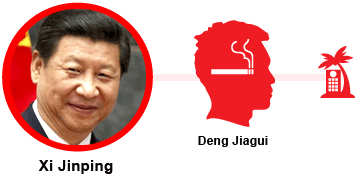

Graphic shows senior Chinese figures and their relatives with offshore connections. There is no indication the leadership figures had any involvement in or awareness of the family members' financial activities.

The documents also disclose the central role of major Western banks and accountancy firms, including PricewaterhouseCoopers, Credit Suisse and UBS in the offshore world, acting as middlemen in the establishing of companies.

The Hong Kong office of Credit Suisse, for example, established the BVI company Trend Gold Consultants for Wen Yunsong, the son of Wen Jiabao, during his father's premiership — while PwC and UBS performed similar services for hundreds of other wealthy Chinese individuals.

The disclosure of China's use of secretive financial structures is the latest revelation from "Offshore Secrets", a two-year reporting effort led by theInternational Consortium of Investigative Journalists (ICIJ), which obtained more than 200 gigabytes of leaked financial data from two companies in the British Virgin Islands, and shared the information with the Guardian and other international news outlets.

In all, the ICIJ data reveals more than 21,000 clients from mainland China and Hong Kong have made use of offshore havens in the Caribbean, adding to mounting scrutiny of the wealth and power amassed by family members of the country's inner circle.

As neither Chinese officials nor their families are required to issue public financial disclosures, citizens in the country and abroad have been left largely in the dark about the elite's use of offshore structures which can facilitate the avoidance of tax, or moving of money overseas. Between $1tn and $4tn in untraced assets have left China since 2000, according to estimates.

China's inequality problem

Income inequality is a mounting issue in China, a consequence of the country's rapid growth. A Beijing university study suggests that income at the richest 5th percentile are 34 times higher than those of the bottom 5th percentile.

percentile

5%

¥1,000

$170

10

¥2,000

$340

25

¥4,500

$765

50

¥9,000

$1,530

75

¥15,900

$2,703

90

¥25,800

$4,386

95

¥34,300

$5,831

Source: Beijing university study, 2012 incomes

China's rapid economic growth is leading to a degree of internal tension within the nation, as the proceeds of the country's newfound prosperity are not evenly divided: the country's 100 richest men are collectively worth over $300bn, while an estimated 300m people in the country still live on less than $2 a day. The Chinese government has made efforts to crack down citizens' movements aimed at promoting transparency or accountability among the country's elite.

The confidential records obtained by the ICIJ relate to the incorporation and ownership of offshore companies, which is legal, and give little if any information as to what activities the businesses were used for once established. Offshore companies can be an important tool for legitimate Chinese businesses, especially when operating overseas, due to restrictions and legislation in the country.

One Chinese political family whose financial affairs have not escaped scrutiny — at least in the west — is that of the former premier, Wen Jiabao. In November, the New York Times reported that a consultancy firm operated by Wen's daughter, who often goes by the name Lily Chang, had been paid $1.8m by the US financial services giant JPMorgan.

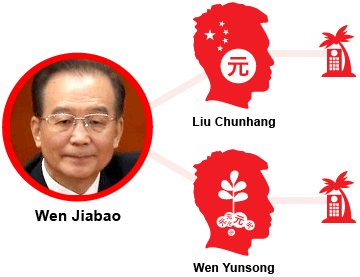

A former premier, a banking regulator and a venture capitalist

Liu Chunhang is the son-in-law of former premier Wen Jiabao, and the husband of Wen's daughter Lily Chang. He currently works for China's banking regulator, and is a former Morgan Stanley employee.

Wen Yunsong is the son of Wen Jiabao. Educated in the USA, at Northwestern University, he is a venture capitalist, and current chairman of a state-owned satellite services company.

Wen Yunsong is the son of Wen Jiabao. Educated in the USA, at Northwestern University, he is a venture capitalist, and current chairman of a state-owned satellite services company.

The payment has become one of the targets of a probe by US authorities into the activities of JPMorgan in China, including an examination of the firm's hiring practices, which are alleged to have included the deliberate targeting of relatives of influential officials.

However, the ICIJ files reveal the role of the BVI's offshore secrecy in obscuring Chang's links with her consulting firm, Fullmark Consultants. The company was set up in the BVI by Chang's husband, Liu Chunhang, in 2004, and he remained as sole director and shareholder until 2006, when he took a job in China's banking regulation agency.

Nominal ownership of the firm was transferred at that time to Zhang Yuhong, a Wen family friend, who the New York Times reported had connections with the Wen family's business interests.

The company established for Chang's brother Wen Yunsong, with the aid of Credit Suisse, was dissolved in 2008, with little hint as to its purpose or activities in the two years it was operational. One purpose for such companies is to allow for the establishment of bank accounts in the company's name, a legal measure that nonetheless makes tracing of assets a more complicated task.

No members of the Wen family, nor Zhang, responded to any of multiple approaches for comment, made over a period of several weeks by ICIJ reporters.

However, in a recent letter dated December 27th apparently sent to a Hong Kong columnist amid public anti-corruption probes into other former officials, Wen Jiabao is reported to have denied any wrongdoing during his premiership, or in how his family obtained their reported wealth.

"I have never been involved and would not get involved in one single deal of abusing my power for personal gain because no such gains whatsoever could shake my convictions," he is reported to have written.

A spokesman for Credit Suisse refused to comment on any specific case or client, but said the bank had "detailed procedures for dealing with politically exposed persons" which complies with money laundering regulations in Switzerland and elsewhere.

"Credit Suisse is required by Swiss law to uphold bank client confidentiality and is therefore unable to comment on this matter," he said. "In the absence of any further information, the media cannot be certain that they have a full understanding of the matter. As a result, they will not be able to portray it accurately or objectively."

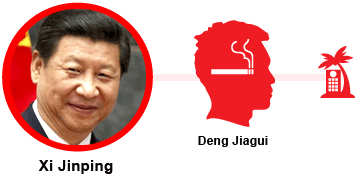

The president and a businessman

Deng Jiagui is a businessman who became the brother-in-law of China's current president Xi Jinping when he married his older sister in 1996. His background is in the tobacco industry, but he and his wife currently own luxury property across China and Hong Kong.

The ICIJ records also detail a company connected to Deng Jiagui, the husband of the older sister of Xi Jinping, China's president, who has cultivated a public image as an anti-corruption campaigner. According to the BVI records, Deng, a real-estate developer and investor, owns a 50% stake in the BVI-incorporated Excellence Effort Property Development. Ownership of the remainder of the company traces back to two Chinese property tycoons, who last year won a $2bn real estate bid.

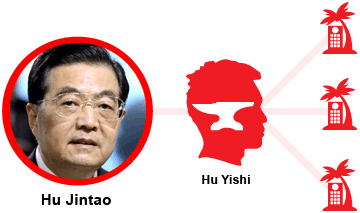

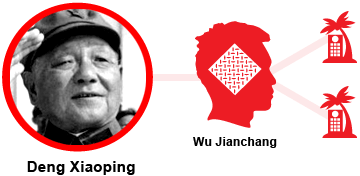

Other "princelings" — a widely-used term for the families of China's political elite — with offshore ties include: Li Xiaolin, a senior executive in one of China's state-owned power firms and the daughter of former premier Li Peng; Wu Jianchang, the son-in-law of China's late "paramount leader" Deng Xiaoping; and Hu Yishi, a cousin of former president Hu Jintao.

China's political elite were not the only individuals taking advantage of the BVI's offshore anonymity. At least 16 of China's richest people, with a combined estimated net worth in excess of $45bn, were found to have connections with companies based in the jurisdiction.

Among those was Huang Guangyu, the founder of China's largest electronics retailer and once the country's richest man. Huang and his wife had a network of more than 30 companies in the BVI, according to the ICIJ records. Huang subsequently fell from grace and was in 2010 sentenced to 14 years in prison for insider trading and bribery.

Despite his imprisonment, Huang's offshore network is not standing idle. In 2011, one of his BVI firms made an unsuccessful bid for the Ark Royal, the retired aircraft carrier which was once the flagship of the British navy. According to press reports, Huang planned to turn the carrier into a shopping mall, but navy officials decided instead to scrap the ship.

Shareholders of offshore companies

China has become a vital client for offshore jurisdictions. The ICIJ's databse of offshore owners and shareholders has six times as many addresses tied to China or Hong Kong than it does to the USA.

China and Hong Kong

21,321

Taiwan

15,835

Singapore

3,843

United States

3,713

Indonesia

2,506

Russia

2,166

Malaysia

1,490

Cyprus

994

United Kingdom

762

India

640

In total, the ICIJ database — which covers just two of the BVI's numerous incorporation agencies — lists more than 21,000 addresses in China or Hong Kong as directors or shareholders of offshore companies, demonstrating the country's status as one of the premier buyers of offshore services. In recent years, offshore jurisdictions have aggressively courted the Chinese market, with many opening offices and promotional sites in Hong Kong.

The BVI's courtship of China's rich and powerful may prove an embarrassment for the United Kingdom. The BVI remains a British overseas territory, and while largely independent in practice, UK authorities retain a degree of responsibility and connection with the islands.

The UK's Prime Minister David Cameron has publicly pledged to take action against offshore secrecy and offshore tax avoidance, including in crown protectorates such as Jersey and Guernsey, and overseas territory, meaning further exposure of the role of the BVI could prove a political embarrassment.

The role of major Western financial institutions in establishing offshore structures has also attracted scrutiny, despite being a routine and entirely legal function for many of them.

The ICIJ records show both PricewaterhouseCoopers and UBS had extensive contacts with incorporation agents in the BVI and other territories in the region. In total, UBS helped incorporate more than 1,000 offshore institutions for clients from China, Hong Kong or Taiwan, while PwC had a role in establishing at least 400.

Both PricewaterhouseCoopers and UBS declined to comment on any specifics regarding their activities in the BVI, or with China's rich. However, spokesmen for both companies said their activities complied with appropriate law and ethical codes.

"As a matter of policy, PwC member firms do not comment about clients or their business," said a spokesman for PwC China.

"PwC's tax advisory practice helps our clients make informed business decisions, balance their responsibilities to do the right thing for multiple stakeholders, often across many countries, and meet their tax requirements."

A UBS spokesman said: "We operate to the highest standards in our business operations to meet all our legal and regulatory requirements."

The amassed wealth and alleged corruption among China's political elite has been a topic of growing interest not only in the Western media, but also — to a limited extent — within China itself.

Spurred on by President Xi's public statements around anti-corruption efforts, a Chinese academic and activist, Xu Zhiyong, inspired a "New Citizens' Movement" in the country — an informal civil society group which among other goals aims to increase the financial transparency of the country's elite and curbing corruption.

The movement, however, has faced strong opposition from Chinese authorities. Numerous participants in the New Citizens Movement have been arrested at public gatherings, while its founder Xu is in prison facing charged of "gathering a crowd to disrupt public order", and faces up to five years in prison. Meanwhile, international journalists who have reported from within the country on the wealth of China's political elite have faced immigration difficulties from the government, or trouble with authorities.

From theguardian: China's princelings storing riches in caribbean offshore haven I

China's princelings storing riches in Caribbean offshore haven

Relatives of political leaders including China's current president and former premier named in trove of leaked documents from the British Virgin Islands

More than a dozen family members of China's top political and military leaders are making use of offshore companies based in the British Virgin Islands, leaked financial documents reveal.

The brother-in-law of China's current president, Xi Jinping, as well as the son and son-in-law of former premier Wen Jiabao are among the political relations making use of the offshore havens, financial records show.

Apple Updates iWork Across Platforms, Brings Password-Protected Sharing To The Web And Mobile

Apple released a number of updates to iWork today, across all platforms, including OS X, iOS and iCloud on the web. Improvements include the addition of customizable alignment guides and a vertical ruler on the Mac, a built-in remote feature on iOS (which replaces the standalone app) and, perhaps most importantly in terms of helping those looking to use iWork for iCloud instead of competitors like Google and Microsoft for web-based document editing and collaboration, password-protected sharing of iWork documents, spreadsheets and presentations.

The password protection for shared documents is a big step, especially among people who want to use iWork as a serious professional tool for sharing documents and presentations with clients with a degree of assurance that only the desired audience will be able to view them. You can now share the docs via iCloud with a user-assigned password using either Pages 2.1 on iOS, or using the iWork for iCloud beta. It’s also easier to review your shared content on the web, thanks to a new list view of all documents, spreadsheets and presentations that have been shared with you.

Other updated features include sorting using multiple columns or rows in Numbers 3.1 on OS X, the addition of new transitions and display options to Keynote, landscape viewing and editing of spreadsheets in Numbers on IOS and keyboard shortcuts object manipulation in the iWork for iCloud beta.

Source: TechCrunch

Apple Patents Multi-Service Digital TV And Radio To Avoid Ads, Buttonless MacBook Touchpad

Apple has a couple of new patents today (via AppleInsider), including one for an audio and video media service that would switch intelligently and automatically between sources in order to provide users with a constant stream of stuff they actually want to watch and listen to, as well as helping them dodge ads. A second patent describes a new design for MacBook trackpad hardware that does away with the need for a physical button.

The first patent is potentially the most interesting, since it essentially paints a picture of a service like iTunes Radio, but with the added benefit that it can use multiple different services to source media, including online streaming services, FM radio and more. A user would create a playlist or station by expressing some preferences about what they want to see or hear (it’s designed to work with both audio and video content) and then sit back and enjoy as it switches between content sources when songs end, or when commercials interject.

To make it seamless, the service described in the patent could record content that fits a users demand on other channels if there’s a conflict in schedule, and also tap the user’s own offline library of media on their devices. Think of it like an intelligent channel surf, except extending across the range of Internet media sources.

The system takes into account various elements when determining what to play next, including metadata about the artist and track, volume, and even hue and color in terms of video programming. A user would control it via a GUI that resembles an FM tuner according to the patent, letting them tweak their preferences to alter the stream. It’s a very ambitious project, and one that seems likely to anger content partners since it can dodge ads on various services, but it’s still something that you can see replacing current methods of engaging with TV and music. Still, if this is on the horizon, expect it to require a lot more refinement and working out before it makes an appearance.

The other patent is for a touchpad design for MacBooks that gets rid of the physical button aspect entirely, but replaces it with a similar sensation. Currently, MacBook support both capacitive touch-based input and physical keypresses, but the keypress requires different amounts of force depending on where you strike thanks to a hinged design, and is subject to wear and tear since it’s a moving part.

Apple’s design replaces that with a complex force sensing system, combined with a means for providing tactile feedback that would emulate a hardware button press. This would have a number of advantages in terms of MacBook construction, from simplifying the hardware involved as mentioned, to saving space within the case of the notebook, which continues to be a key concern in building Apple devices in terms of providing more room for larger batteries and other components. Also, the force feedback used in the trackpad could be triggered by incoming email, letting it act just like vibration alerts on your iPhone.

This is a tech that would be handy, but people are very used to the feeling of Apple’s current trackpad, which is often described as among the best in the business. Still, force feedback on a notebook Mac would open up all kinds of possibilities and make sense to Mac users moving to the platform after getting an iPhone, so there’s a chance we could see it implemented in future designs.

Source: TechCrunch

Google Awarded Patent For Free Rides To Advertisers’ Locations

Google may soon offer a new service that combines its advertising business with its knowledge about local transport options, taxis and – in the long run – autonomous cars. The U.S. Patent and Trademark Office last week granted Google a patent for arranging free (or highly discounted) transportation to an advertiser’s business location.

Here’s how it works. Say a Vegas casino really wants your business. Not only could it offer you some free coins, but if it deems the cost worthwhile (using Google’s automated algorithms, of course), it could just offer you a free taxi ride or send an autonomous car to pick you up.

Google’s now-patented algorithms would take into account things like a user’s current location, the route and potential forms of transportation (train, personal car, taxi, rental car, or shared vehicle) to an advertiser’s business, as well as the user’s daily agenda and “ the price competing advertisers are willing to pay for the customer to be delivered to alternate locations.”

Google’s now-patented algorithms would take into account things like a user’s current location, the route and potential forms of transportation (train, personal car, taxi, rental car, or shared vehicle) to an advertiser’s business, as well as the user’s daily agenda and “ the price competing advertisers are willing to pay for the customer to be delivered to alternate locations.”

As Google notes, the most difficult part about getting a sale for a brick-and-mortar business can often be getting people to your location. Google says its invention would make getting a potential customer into a business easier for stores that otherwise would have to invest in more expensive locations close to high-traffic areas.

In at least one of Google’s examples, this involved using an autonomous car, though low-tech options like giving people coupons for public transport are also part of the patent. Google would use a customer’s preferences, as well as the price an advertiser would be willing to pay, to determine the best offer to a user.

Advertisers, of course, could use a number of factors to determine who they want to target. A theme park, the patent notes, could choose to just advertise to “users indicating that they are accompanied by one or more children in order to increase revenue.”

Just like Google’s other advertising options, the patent envisions a bidding system where different advertisers get to compete for customers. Those bids, Google says, could be based on a customer’s buying history and other factors. “For example,” the patent’s authors write, “advertisers may bid more to have customers which consistently use the transportation service to make purchases as compared to those who appear to travel without actually having made any purchases.”

Users may also have to identify themselves when their car arrives, and advertisers may also bid on having a car pick up customers to take them back to their homes or original pick-up locations.

Source: TECHCRUNCH

Apple Patents Sapphire Display Tech After Last Year’s $578M Deal With Sapphire Maker

Apple has had a patent approved today (via AppleInsider) that could make it a leader in a new kind of display material technology: Sapphire glass. The patent describes various methods for attaching sapphire crystal to electronic devices, and includes a description of how it does this with the sapphire glass covering the iPhone camera lens introduced with the iPhone 5, as well as a means for attaching sapphire as a cover for the whole display.

In the past, the iPhone has used Gorilla Glass to protect its screen (though some believe it may have stopped recently); Apple championed this tech and basically made its maker Corning the default choice for smartphone OEMs looking for a tough, scratch-resistant material to use to protect their screens. But last year, Apple made a $578 million bet on sapphire (which is used often in good watches) with GT Advanced Technologies to have it build a manufacturing plant for the material in Arizona.

When the deal was announced, our own Matthew Panzarino took a closer look at the investment, and at what sapphire glass could provide Apple. Sapphire, including the lab grown variety, is much tougher, more resistant to scratches, and more resistant to breakage after scratches than even Gorilla Glass, which has a strong reputation in all those arenas. It’s heavier, too, but would potentially allow Apple to use thinner pieces for both space and weight savings.

Of course, there are also existing needs at Apple for sapphire glass, including the iPhone camera lens and the new Touch ID-compatible home button, which many expect to make its way to other Apple devices including the iPad eventually. But the patent uses an iPhone-type device as its illustrative example, and specifically states that while the gadget depicted is a “smart phone,” the techniques described could be used on any number of devices. A smartwatch might be a good target case, for example, given that Apple has been rumored to have been working on one for some time, and that sapphire is a very common case material used in the manufacture of watches from most leading brands.

The patent itself details ways in which the sapphire material could be attached to the shell or casing of an electronic device, with examples in illustrations detailing jigsaw-type and tounge-and-groove mechanics for keeping the glass firmly in place.

At this stage, it’s more likely that Apple is simply laying the groundwork for a potential shift to sapphire in its phones and other devices a considerable way down the road, rather than tipping its hand for any immediately upcoming change in how its devices are made, but this patent demonstrates that it is indeed thinking in terms of smartphone displays and other applications that go beyond its current uses of the material.

Source: TechCrunch

Subscribe to:

Comments (Atom)

Popular Posts

-

The Dow and the S&P 500 finished lower for the fourth consecutive session on Wednesday after investors found few reasons to make big m...

-

Composite Index - W/W Change -1.2 % -3.7 % Purchase Index - W/W Change -2.0 % -3.0 % Refinance Index - W/W Change 1.0 % -4.0 % A roug...

-

China's first 8-inch IGBT (insulated gate bipolar transistor) chip production line, built by CSR (China South Locomotive & Rolling...

-

"This is the first time in recorded history that we have every major central bank in the world printing money, so the world is floatin...

-

The Communist Party of China (CPC) has vowed to firmly fight corruption and maintain its "high-handed posture" in the next five ...

-

China's top economic planning body, the National Development and Development Reform Commission says it will delegate more powers and f...

-

"Less tax for small businesses and more financial support for local government are on the cards as the Chinese leadership considers t...

-

One of the leading internet television businesses, Youku Tudou Inc (ADR) (NYSE:YOKU) is on its course to acquire greater strengths in t...

-

The Chinese central government on Tuesday published its first white paper on the work of Hong Kong Special Administrative Region (HKSAR),...

-

Después de tres años de negociaciones, el Gobierno de Ecuador está preparado para firmar un acuerdo con China valorado en US$7.000 millone...