|

| Add caption |

Give a more longer term perspective of Economic trends and the Macroeconomic and Monetary Interdependence of the Global Economy. With the Background of this approach the blog will deal with the implications for Investment decisions. The author believes that China and the Asia Pacific Region are and will be the powerhouse for the global economic growth for years to come. It will also cover IT because of its momentum driver for economic growth.

Friday, 21 March 2014

Despite running at a loss, JD valuation jumps to $15.7 billion ahead of US listing

JD.com (a.k.a. Jingdong) updated its SEC prospectus today, showing the company’s equity valuation nearly doubled since December to US$15.7 billion. That huge jump comes despite JD falling short of profit last year, reporting a narrow US$8.1 million operating loss in 2013. The update also shows a new ownership structure, with founder Richard Liu increasing his stake to 18.8 percent, making him the second-largest shareholder after Tiger Global Management. Once Tencent takes its stake, it will become the third-largest stakeholder. JD’s prospectus includes some out-of-the-ordinary anti-takeover measures in favor of Liu. The Financial Times notes that the board may not vote unless Liu is present, which means he could block a vote by calling in sick. Also, if for any reason Liu is sent to prison or otherwise forcibly confined, he’ll remain in control of the company.

These stipulations resemble Jack Ma’s attempts to keep a tight hold on Alibaba when courting the Hong Kong stock exchange for an IPO. His efforts eventually foundered, and Alibaba decided to file in the US where the rules on ownership structures are more lenient. JD will be the biggest Chinese tech IPO to list in the US, at least until Alibaba completes its paperwork. To avoid a conflict of interest, the two companies have prohibited any one bank from sponsoring both of them. JD hopes to raise US$1.5 billion from its public listing.

Source: TECHINASIA

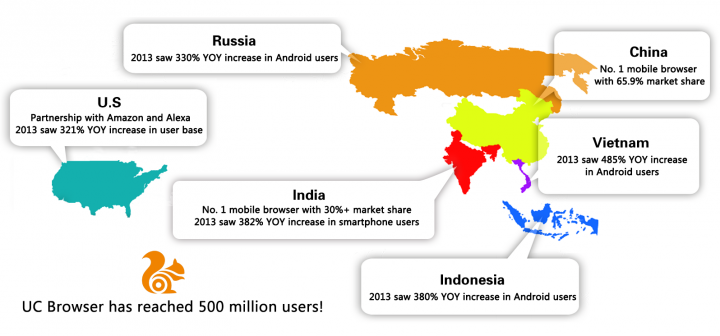

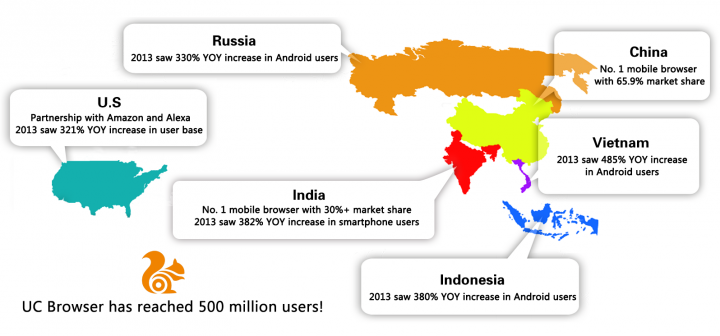

World’s most popular mobile browser from China soars past the half billion user mark as it picks up steam overseas

Source: TECHINASIA

UC Browser,the world’s most popular third-party mobile browser made by China’s UCWeb, announced today it passed the 500 million global quarterly active user mark. UCWeb reported hitting the 400 million user threshold in May of last year, which means the browser gained an additional 100 million in less than 12 months. 300 million of its users are on Android. To put that into perspective, China’s top messaging app and social network WeChat recently reported 355 million monthly active users. UC Browser’s figure is somewhat inflated because it is using quarterly stats as opposed to monthly, but it’s an impressive figure nonetheless.

China is home to UCWeb’s largest userbase, holding 65 percent of the mobile browser market share, according to iResearch. Smartphone users in China spend twice as much time on mobile browsers as they did a year ago. In August, UC Browser overtook Opera as India’s top mobile browser, and now accounts for 32 percent market share according to StatCounter. UC Browser is available for free on Android, iOS, Symbian, Java, Windows Phone, Windows Mobile, and Blackberry. UC Browser was also released for Android-based Smart TVs earlier this month.

UC Browser,the world’s most popular third-party mobile browser made by China’s UCWeb, announced today it passed the 500 million global quarterly active user mark. UCWeb reported hitting the 400 million user threshold in May of last year, which means the browser gained an additional 100 million in less than 12 months. 300 million of its users are on Android. To put that into perspective, China’s top messaging app and social network WeChat recently reported 355 million monthly active users. UC Browser’s figure is somewhat inflated because it is using quarterly stats as opposed to monthly, but it’s an impressive figure nonetheless.

China is home to UCWeb’s largest userbase, holding 65 percent of the mobile browser market share, according to iResearch. Smartphone users in China spend twice as much time on mobile browsers as they did a year ago. In August, UC Browser overtook Opera as India’s top mobile browser, and now accounts for 32 percent market share according to StatCounter. UC Browser is available for free on Android, iOS, Symbian, Java, Windows Phone, Windows Mobile, and Blackberry. UC Browser was also released for Android-based Smart TVs earlier this month.

Tencent boosts ecommerce business yet again with $180 million stake in property portal

Source: TECHINASIA

Chinese web giant Tencent has paid US$180 million to take a 15 percent stake in a major real estate portal and ecommerce site in the country, the company said this evening. Tencent’s stake is in Leju, which is a subsidiary of E-House (NYSE:EJ). Leju is in the process of being spun off from E-House for its own US IPO, at an unscheduled point this year. Leju’s F1 filing with the US SEC is here. This new deal comes just eleven days after Tencent radically shook up its struggling ecommerce business by taking a 15 percent stake in Amazon-style estore JD. As part of that agreement, JD will run part of Tencent’s online shopping business.

Leju (pictured below) has real estate listings, a property search engine, and an ads platform to make money from property-related ads. Tencent already has its own ads-stuffed property portal at house.qq.com. The killer part of the deal for Leju is that – according to Tencent president Martin Lau – the partnership “will bring Leju’s rich real estate information to WeChat users” in China. Perhaps Chinese users of WeChat will soon be able to buy a house within the messaging app. That’s not too far fetched since they can already use it to buy stuff or book a taxi.

Chinese web giant Tencent has paid US$180 million to take a 15 percent stake in a major real estate portal and ecommerce site in the country, the company said this evening. Tencent’s stake is in Leju, which is a subsidiary of E-House (NYSE:EJ). Leju is in the process of being spun off from E-House for its own US IPO, at an unscheduled point this year. Leju’s F1 filing with the US SEC is here. This new deal comes just eleven days after Tencent radically shook up its struggling ecommerce business by taking a 15 percent stake in Amazon-style estore JD. As part of that agreement, JD will run part of Tencent’s online shopping business.

Leju (pictured below) has real estate listings, a property search engine, and an ads platform to make money from property-related ads. Tencent already has its own ads-stuffed property portal at house.qq.com. The killer part of the deal for Leju is that – according to Tencent president Martin Lau – the partnership “will bring Leju’s rich real estate information to WeChat users” in China. Perhaps Chinese users of WeChat will soon be able to buy a house within the messaging app. That’s not too far fetched since they can already use it to buy stuff or book a taxi.

ICIS: Tight supply for Nigeria LNG cargoes over 2015-2016 period

"A five-year supply tender for up to 30

Nigeria LNG cargoes from October 2015

closed on 5 March attracting a wide range

of bids that can be used as a yardstick for

the global LNG forward curve.

The value of cargoes on offer from Lisbon-based

Nigerian offtaker, Galp Energia, were widely deemed to

be backwardated over the period. Most traders attached

a premium over the 2015-2016 period in accordance

with expected liquefaction delays in Australia, while the

consequent onset of export ramp-ups both in Australia

and the USA from 2017-2020 saw lower-valued cargoes

at the back end of the period.

Traders were required to submit a single bid for either

the entire 30 cargoes over the 2015-2020 period or for

specified sub-sections of the lifting period. The pricing

behind all bids had to be made at a 10.5% index to Brent

crude oil plus a constant. The constant is understood to

be Galp’s margin on its NLNG agreement.

While Galp will be keenly aware of a recent tender award

for 2014-2015 Nigeria cargoes settling at 14-14.5% Brent,

one trader said it may turn down a comparable bid for its

near-term string, preferring instead to go for a lower-value

bid that stretches over the entire period or just the back

end towards 2020.

On the sell side, Galp - which expects to receive equity LNG

from Mozambique by the end of the decade, may do well to

lock in forward value in today's relatively under-supplied

global market".

"As it becomes very difficult to assess the market

beyond 2016, the trader explained he could only put in a

conservative bid to cover cargoes from 2017-2020".

Source: ICIS

Nigeria LNG cargoes from October 2015

closed on 5 March attracting a wide range

of bids that can be used as a yardstick for

the global LNG forward curve.

The value of cargoes on offer from Lisbon-based

Nigerian offtaker, Galp Energia, were widely deemed to

be backwardated over the period. Most traders attached

a premium over the 2015-2016 period in accordance

with expected liquefaction delays in Australia, while the

consequent onset of export ramp-ups both in Australia

and the USA from 2017-2020 saw lower-valued cargoes

at the back end of the period.

Traders were required to submit a single bid for either

the entire 30 cargoes over the 2015-2020 period or for

specified sub-sections of the lifting period. The pricing

behind all bids had to be made at a 10.5% index to Brent

crude oil plus a constant. The constant is understood to

be Galp’s margin on its NLNG agreement.

While Galp will be keenly aware of a recent tender award

for 2014-2015 Nigeria cargoes settling at 14-14.5% Brent,

one trader said it may turn down a comparable bid for its

near-term string, preferring instead to go for a lower-value

bid that stretches over the entire period or just the back

end towards 2020.

On the sell side, Galp - which expects to receive equity LNG

from Mozambique by the end of the decade, may do well to

lock in forward value in today's relatively under-supplied

global market".

"As it becomes very difficult to assess the market

beyond 2016, the trader explained he could only put in a

conservative bid to cover cargoes from 2017-2020".

Source: ICIS

What does U.S. know about Putin's oil wealth?

The most startling part of Washington's sanctions on Russian businessmen loyal to President Vladimir Putin may be a single sentence that contains an explosive allegation: that Putin himself profits from the world's No. 4 oil trading company, Gunvor.

Among the people the United States sanctioned on Thursday as part of its drive to put pressure on Russia for its intervention in Ukraine was businessman Gennady Timchenko, a long-time acquaintance of Putin and, until this week, co-owner of Geneva-based Gunvor, which trades nearly 3 percent of the world's oil.

In announcing the sanctions, the Treasury Department went a step further, adding a single sentence that hits squarely at one of the most controversial topics that Putin has faced in 13 years as the Kremlin ruler and head of the government.

"Timchenko activities in the energy sector have been directly linked to Putin. Putin has investments in Gunvor and may have access to Gunvor funds," the statement said.

Source: Reuters

European Union prepares for trade war with Russia over Crimea

Europe began to prepare for a possible trade war with Russia over Ukraine on Friday, with the EU executive in Brussels ordered to draft plans for much more substantive sanctions against Moscow if Vladimir Putin presses ahead with Russian territorial expansion.

But the bigger EU countries – Germany, France and Britain, all with major but very different interests at stake in Russia – split over the tactics of a new campaign with fears that a trade war would be highly risky and potentially ruinous.

A two-day summit of EU leaders dominated by the Crimea crisis ended with 12 Russian politicians and military figures being added to a list of 21 so far subjected to travel bans and asset freezes.

Unlike Washington, which on Thursday blacklisted senior Kremlin figures and oligarchs, the EU list avoided Putin's immediate entourage, instead targeting figures such as Sergei Glazyev, an economic adviser to Putin, Dmitry Rogozin, a deputy prime minister, and the heads of both houses of parliament. "The persons are not so important," said a senior EU official. "It's the climate we're creating." He denied any differences with the Americans. "It's not a beauty contest."

The summit debate, participants and witnesses said, focused on what is known as "stage 3" of a sanctions regime, meaning broader trade and economic sanctions against Russia if the Kremlin escalates operations to seize more territory in Ukraine beyond the Black Sea peninsula of Crimea, whose annexation was formally concluded on Friday in Moscow.

David Cameron reserved strong language for the Kremlin move. "A sham and illegal referendum has taken place at the barrel of a Kalashnikov," he said. "Russia has sought to annex Crimea, a flagrant breach of international law and something we will never recognise."

Moscow criticised the Foreign Office for its choice of rhetoric on the Ukraine crisis. "We are being reassured that the British government wants to maintain normal diplomatic relations with the Russian Federation. If that is the wish of our British partners, then this relationship has got to be normal and diplomatic including at the level of rhetoric. Good relations ought to be valued. The British side should mind its language. Unfortunately, that's not the case with the British Embassy in Moscow," said the Russian foreign ministry. "It seems that the harsh rhetoric, quite beyond the pale, is meant to cover up the gross inaptitude of the Brussels bureaucracy and its zero-sum motive to engineer a cold war-type geopolitical grab on Russia's borders."

Cameron pointed out that while the EU depended on Russia for a quarter of its gas supplies, the Russian gas monopoly Gazprom relied on Europe for half of its exports. "Russia needs Europe more than Europe needs Russia," he said.

The European commission in Brussels was told to draw up plans for sanctions "in a broad range of economic areas".

Such language masked differences between Britain and France on the one hand and Germany on the other. Following the summit, Germany's chancellor, Angela Merkel, failed to mention the next phase of much more serious penalties, while Cameron emphasised them.

On Thursday, the White House named metallurgy, energy, trade and other areas as possible targets for action. London and Paris wanted to echo this. "The Russians have to see where they will hurt," said one diplomat. Germany, by far Russia's biggest trade partner in the EU and the biggest buyer of Russian gas, has resisted attempts to specify what the sanctions targets might be.

Apart from its energy dependency, the Germans say they have more than 6,000 firms operating in Russia and that 300,000 jobs in Germany depend on trade with Russia.

Cameron was much more explicit on the issue and British officials admitted there were divisions. He mentioned "finance, military, energy" as areas being considered. "There's nothing left out."

That suggested equal pain for the three big countries since Britain has most to lose from financial sanctions, France has billion of euros at stake in defence contracts with Russia, while Germany suffers most from sanctions in the energy sector.

It is not clear when the European commission will deliver its battle plan for expanded sanctions but there is an acute feeling among commission officials that Brussels has been handed a poison chalice. They said as soon as the plans are published or leaked, the Russians will know what to expect or fear and will get their retaliation in pre-emptively, triggering a much bigger crisis between Europe and Russia.

The senior EU official, though, said it would be "really stupid" for the EU to reveal its hand. "The commission is keeping its cards close to its chest. We will not do this in full transparency. It will not be transparent at all."

While the Americans have been much more open in spelling out their plans, the Europeans complain that it is easier for Washington because it has much less to lose, with US-Russian trade volumes barely one-twelfth of that between the EU and Russia.

The senior official said the blacklist was not coordinated with Washington. "We are following our own course. The US is far away."

The EU and the interim Ukrainian government have now signed part of a political and trade pact, the issue that led to the crisis last November that ultimately triggered a revolution in Kiev and Russian intervention in Crimea.

The EU summit agreed to race ahead with similar pacts with Moldova and Georgia, concluding them by June.

Source: theguardian

China says plans to speed up investment, stabilise demand

Premier Li Keqiang said China will speed up investment and construction plans to ensure domestic demand expands at a stable rate - an indication authorities are considering practical measures to support slackening economic growth.

Li said at a weekly cabinet meeting that China needs to roll out approved plans for growing domestic demand to keep growth in the economy in a "reasonable range".

No further details were given in an official statement following the meeting, and it was not clear if Li had given authorities a green light to accelerate new investment, or to start work on projects that have already been approved.

But his remarks, which came after China quietly revealed last week that it had signed off on 142 billion yuan ($23 billion) worth of railway projects this year, stoked talk among analysts that Beijing is ready to stimulate the economy.

China rattled financial markets earlier this month with data showing growth in investment, retail sales and factory output plumbing multi-year lows in January and February.

Investors, multinational companies and its major trading partners fear a sharper-than-expected slowdown in China will soon drag on activity across the world.

Ramping up state investment to shore up the economy has been par for the course in China in recent years.

In 2008/09, in the face of the global financial crisis, Beijing approved a whopping 4 trillion yuan ($645 billion) of state spending funded partly by bank loans.

That spending helped China recover quickly from the crisis, but the mountain of debt incurred fed other credit problems that the government now hopes to fix, in part by abandoning its former export- and investment-driven growth model.

Stimulus measures announced in several economic soft patches since then have been more modest and more focused, such as last year's spending on social housing, infrastructure and energy-saving industries, and tax breaks for smaller firms.

The five railway projects tipped last week were approved in January and February and will get half of their funding from bank loans, according to the country's economic planner, the National Development and Reform Commission.

Some analysts cautioned investors against taking the latest projects as an indication that China is ramping up spending again, as the construction sector usually picks up in March as the weather turns warm.

They said if China does increase investment in coming months, it would be a setback for broader economic reforms, but arguably an unavoidable one as Beijing is intent on growing the economy by around 7.5 percent this year to boost incomes and employment.

"Of course it will compromise reforms, but the starting point is that the government has to seek a compromise between growth and reforms," said Tao Wang, an economist at UBS. "It was always meant to be a balance."

At a plenum meeting of the Communist Party last November, China announced ambitious reforms that signalled the shift of the world's second-biggest economy from investment- and export-fuelled growth towards a slower, more balanced and sustained expansion.

Some changes, such as government downsizing or closures of debt-laden factories, are likely to take a back seat to avoid fuelling job losses and undermining social stability, analysts have said.

China has been showing some determination to reform and few experts believe Beijing will launch another super-sized stimulus to prop up the economy.

On Thursday, the government relaxed rules to allow more foreigners to invest in its stock markets, the latest step to free its financial markets after widening the yuan's trading band at the weekend, taking it closer to turning the yuan into a convertible, global currency.

China also has lifted a ban on equity financing for listed property developers for the first time in four years, a step that could herald less government intervention in the sector and ease funding concerns as credit grows tight and the economy slows.

The approvals come amid growing fears of defaults in the property sector after the collapse of Zhejiang Xingrun Real Estate.

Some analysts believe China's central bank is engineering the recent slide in the yuan to cushion the weakening economy by making exports more competitive, and others speculate that the government may step up efforts to bolster growth in coming months.

Analysts from government-controlled think-tanks told Reuters last week that Beijing may loosen monetary policy by reducing the level of deposits commercial banks must keep at the central bank if the economic growth slips below its 7.5 percent target.

Beijing could re-energise the economy by increasing government spending, which may involve familiar themes of greater investment in railway construction, public housing and environmental projects such as water conservation.

Source: Reuters

Li said at a weekly cabinet meeting that China needs to roll out approved plans for growing domestic demand to keep growth in the economy in a "reasonable range".

No further details were given in an official statement following the meeting, and it was not clear if Li had given authorities a green light to accelerate new investment, or to start work on projects that have already been approved.

But his remarks, which came after China quietly revealed last week that it had signed off on 142 billion yuan ($23 billion) worth of railway projects this year, stoked talk among analysts that Beijing is ready to stimulate the economy.

China rattled financial markets earlier this month with data showing growth in investment, retail sales and factory output plumbing multi-year lows in January and February.

Investors, multinational companies and its major trading partners fear a sharper-than-expected slowdown in China will soon drag on activity across the world.

Ramping up state investment to shore up the economy has been par for the course in China in recent years.

In 2008/09, in the face of the global financial crisis, Beijing approved a whopping 4 trillion yuan ($645 billion) of state spending funded partly by bank loans.

That spending helped China recover quickly from the crisis, but the mountain of debt incurred fed other credit problems that the government now hopes to fix, in part by abandoning its former export- and investment-driven growth model.

Stimulus measures announced in several economic soft patches since then have been more modest and more focused, such as last year's spending on social housing, infrastructure and energy-saving industries, and tax breaks for smaller firms.

The five railway projects tipped last week were approved in January and February and will get half of their funding from bank loans, according to the country's economic planner, the National Development and Reform Commission.

Some analysts cautioned investors against taking the latest projects as an indication that China is ramping up spending again, as the construction sector usually picks up in March as the weather turns warm.

They said if China does increase investment in coming months, it would be a setback for broader economic reforms, but arguably an unavoidable one as Beijing is intent on growing the economy by around 7.5 percent this year to boost incomes and employment.

"Of course it will compromise reforms, but the starting point is that the government has to seek a compromise between growth and reforms," said Tao Wang, an economist at UBS. "It was always meant to be a balance."

At a plenum meeting of the Communist Party last November, China announced ambitious reforms that signalled the shift of the world's second-biggest economy from investment- and export-fuelled growth towards a slower, more balanced and sustained expansion.

Some changes, such as government downsizing or closures of debt-laden factories, are likely to take a back seat to avoid fuelling job losses and undermining social stability, analysts have said.

China has been showing some determination to reform and few experts believe Beijing will launch another super-sized stimulus to prop up the economy.

On Thursday, the government relaxed rules to allow more foreigners to invest in its stock markets, the latest step to free its financial markets after widening the yuan's trading band at the weekend, taking it closer to turning the yuan into a convertible, global currency.

China also has lifted a ban on equity financing for listed property developers for the first time in four years, a step that could herald less government intervention in the sector and ease funding concerns as credit grows tight and the economy slows.

The approvals come amid growing fears of defaults in the property sector after the collapse of Zhejiang Xingrun Real Estate.

Analysts from government-controlled think-tanks told Reuters last week that Beijing may loosen monetary policy by reducing the level of deposits commercial banks must keep at the central bank if the economic growth slips below its 7.5 percent target.

Beijing could re-energise the economy by increasing government spending, which may involve familiar themes of greater investment in railway construction, public housing and environmental projects such as water conservation.

Source: Reuters

Russia good place to start for Dominique Strauss-Kahn's macro fund

Finance is more forgiving than politics. Dominique Strauss-Kahn is trying to raise $2 billion to launch a macro hedge fund. The first stop on the roadshow is China. But given current events, the former French finance minister and International Monetary Fund managing director may find that his best bet is to convince his many Russian friends that he can make them money.

When DSK, as Strauss-Kahn is widely known, was arrested for sexual assault in New York in May 2011, Vladimir Putin, then Russia's prime minister, went public with his scepticism and hinted at a dark conspiracy. After Strauss-Kahn quit his IMF job and, months later, prosecutors dropped the charges, he embarked on a low-profile career as an international consultant. He soon found work in Russia.

He now sits on the board of the bank owned by Rosneft, Russia's largest oil company, whose chief executive, Igor Sechin, narrowly avoided appearing on the list of individuals hit by Western sanctions, according to news reports. Strauss-Kahn is also a director of the Kremlin-sponsored fund designed to attract foreign investment to Russia, a task that will be arduous in the months ahead.

Moscow, though, is not the only place where a chequered past as a politician is no impediment to a lucrative present in business. Nicolas Sarkozy, whom Strauss-Kahn might have challenged in the last French presidential election had his career not taken its bizarre twist, recently explored launching a private equity fund with Qatari money. Big fund management firms routinely stuff their international advisory boards with retired or outcast politicians. The idea is to turn connections into profit.

DSK will try to make successful investments, not just collect generous consulting fees like some of his former peers. That could be a tough sell, even to his Russian circle. Macro funds have disappointed hedge fund investors lately, losing money on average in all of the last three years, according to Hedge Fund Research. Successful or not, his foray into the world of two-and 20 fees will add to general voter cynicism, as public service looks more and more like just a stepping stone towards the world of real money.

Source: Reuters

When DSK, as Strauss-Kahn is widely known, was arrested for sexual assault in New York in May 2011, Vladimir Putin, then Russia's prime minister, went public with his scepticism and hinted at a dark conspiracy. After Strauss-Kahn quit his IMF job and, months later, prosecutors dropped the charges, he embarked on a low-profile career as an international consultant. He soon found work in Russia.

He now sits on the board of the bank owned by Rosneft

Moscow, though, is not the only place where a chequered past as a politician is no impediment to a lucrative present in business. Nicolas Sarkozy, whom Strauss-Kahn might have challenged in the last French presidential election had his career not taken its bizarre twist, recently explored launching a private equity fund with Qatari money. Big fund management firms routinely stuff their international advisory boards with retired or outcast politicians. The idea is to turn connections into profit.

DSK will try to make successful investments, not just collect generous consulting fees like some of his former peers. That could be a tough sell, even to his Russian circle. Macro funds have disappointed hedge fund investors lately, losing money on average in all of the last three years, according to Hedge Fund Research. Successful or not, his foray into the world of two-and 20 fees will add to general voter cynicism, as public service looks more and more like just a stepping stone towards the world of real money.

Marc Faber Thoughts in Bloomberg Surveillance with Tom Keene

There are indications of a tightening of international liquidity.

Corporate profits in U.S. Companies will continue to contract.

Money has not flowed evenly to all asset classes.

And talking in terms of sectors it has flowed into financials,services and well to do people.

We are in a risk of a Systemic Crisis, and we all are going to loose no matter which asset

class we hold.

Corporate profits in U.S. Companies will continue to contract.

Money has not flowed evenly to all asset classes.

And talking in terms of sectors it has flowed into financials,services and well to do people.

We are in a risk of a Systemic Crisis, and we all are going to loose no matter which asset

class we hold.

Experts: European Union divesification from Russian Gas supply post 2020, and difficult to achieve.

Russia's seizure of the Crimea and its threat to cut off gas to Ukraine, a transit route to the rest of Europe, have revived calls to reduce the EU's reliance on Moscow for energy, but the blocs options are limited and costly. [

The European Union made some progress in improving its energy security after rows over unpaid gas bills between Kiev and Moscow led to the disruption of supplies to western Europe in 2006 and 2009.

By improving its pipeline network, the EU is better prepared for a new supply disruption, but it has not managed to reduce Russia's share of European energy supplies.

Russia today is Europe's biggest supplier of oil, coal and natural gas, meeting around a third of demand for all those fuels, according to Eurostat data, and receiving in return a thumping $250 billion a year.

European leaders said on Friday that the stand-off with Moscow over Crimea made them more determined than ever to end decades of dependence on Russian gas, but they will have to work hard to convince the sceptics.

"The curious feature of the energy policy that emerged from the middle of the last decade is just how little serious effort has been put into security - in particular Eastern security," said Dieter Helm of Oxford University in a research paper this week.

While buyers can switch oil and coal suppliers relatively quickly and easily, Europe receives most of its gas through pipelines that are fed by only one supplier, chief among them Russia's state-controlled Gazprom.

"Gazprom's market share in Europe is increasing (due to decline of European production). So the aim of diversification of our supply is not going to be achieved this side of 2020," said Thierry Bros, gas analyst at French Bank Societe Generale.

"The question of diversification of supply post 2020, what is now in discussion in Brussels, is going to be very difficult to achieve, as with (gas) prices just below $10 per million British thermal units (mmBtu), Russia is making alternative developments for Europe less profitable," he added.

Source: Reuters

The European Union made some progress in improving its energy security after rows over unpaid gas bills between Kiev and Moscow led to the disruption of supplies to western Europe in 2006 and 2009.

By improving its pipeline network, the EU is better prepared for a new supply disruption, but it has not managed to reduce Russia's share of European energy supplies.

Russia today is Europe's biggest supplier of oil, coal and natural gas, meeting around a third of demand for all those fuels, according to Eurostat data, and receiving in return a thumping $250 billion a year.

European leaders said on Friday that the stand-off with Moscow over Crimea made them more determined than ever to end decades of dependence on Russian gas, but they will have to work hard to convince the sceptics.

"The curious feature of the energy policy that emerged from the middle of the last decade is just how little serious effort has been put into security - in particular Eastern security," said Dieter Helm of Oxford University in a research paper this week.

While buyers can switch oil and coal suppliers relatively quickly and easily, Europe receives most of its gas through pipelines that are fed by only one supplier, chief among them Russia's state-controlled Gazprom

"Gazprom's market share in Europe is increasing (due to decline of European production). So the aim of diversification of our supply is not going to be achieved this side of 2020," said Thierry Bros, gas analyst at French Bank Societe Generale.

"The question of diversification of supply post 2020, what is now in discussion in Brussels, is going to be very difficult to achieve, as with (gas) prices just below $10 per million British thermal units (mmBtu), Russia is making alternative developments for Europe less profitable," he added.

Subscribe to:

Comments (Atom)

Popular Posts

-

We’re just a week away from the opening of our Startup Asia Singapore 2014, which is on May 7 and 8. The conference opens with a reminder o...

-

Nominal GDP Year Country/Region ...

-

U.S. stocks pushed higher toward new records on Monday, with the Nasdaq Composite topping 4,000, as a deal with Iran boosted investors...

-

The WSJ reports, "Alibaba said Thursday it bought a 50% stake in China's Guangzhou Evergrande soccer team for 1.2 billion...

-

China's factory activity shrank again in February as output and new orders fell, a private survey found on Monday, reinforcing concern...

-

Japanese researchers said Thursday they had moved a step closer to an oral treatment for diabetes, offering hope of a breakthrough against...

-

British factory orders have jumped unexpectedly this month to their strongest level since March 1995, the Confederation of British Industr...

-

According to a report from the Wall Street Journal: Stocks in Tokyo closed at a six-year high Thursday, pacing a broadly higher sessi...

-

Although signs of stabilization are emerging in the eurozone, the European Central Bank (ECB) is still far from exiting or scaling back it...

-

"The unexpected fall of the yuan against the US dollar since mid February has gained far more attention than is justified by its size...