The WSJ reports, "Iraq's real significance for oil may have less to do with what transpires this summer and more over the rest of this decade. The direct threat to the country's oil exports actually isn't acute yet. For now, the insurgency is focused in central Iraq, away from the main oil-producing and exporting areas in the south and the largely Kurdish-controlled north".

"The bigger issue is what the sudden advance of the Islamic State of Iraq and al-Sham means for Iraq's oil-production growth prospects".

"In its latest medium-term forecast, released Tuesday, the International Energy Agency cut its supply-growth outlook for Iraq. It now expects Iraq to be able to produce 4.29 million barrels a day by 2018, almost half a million barrels a day less than last year's forecast. Even so, Iraq still accounts for 61% of expected growth in output capacity controlled by the Organization of the Petroleum Exporting Countries. So even if the near-term threat to supply from ISIS isn't catastrophic, the wider context potentially is".

Iraq's borders now look more like dotted lines, possibly portending a situation like Libya's, where rival groups vie for power or separation with a weak central government.

In Libya, that instability has caused production to yo-yo between virtually zero and about 1.75 million barrels a day. Now, it is down at about 250,000 barrels a day. In 2010, before Libya blew up, the IEA forecast output of more than two million barrels a day in 2015. Now, Libya isn't seen getting anywhere near that even by 2019.

In Iraq's case, even if Baghdad doesn't fall, ISIS may establish itself in a large swath of the country, remaining a force for instability. Worse, Iraq is now an arena for wider rivalries between Sunni and Shiite Muslims backed by their patrons, Saudi Arabia and Iran.

Such instability means even the IEA's reduced forecasts look questionable, as the investment needed to develop Iraq's oil could be deterred or blocked outright. That is bullish for longer-dated oil futures. Yet these haven't reacted as much as near-term prices, suggesting gains to be made. For example, while average Brent prices for the rest of 2014 have risen by 3.3% in the past week, average 2018 prices are up by less than 1%. Moreover, those 2018 prices are roughly where they were at the end of 2010 just before Libya blew up—yet this crisis could be much worse.

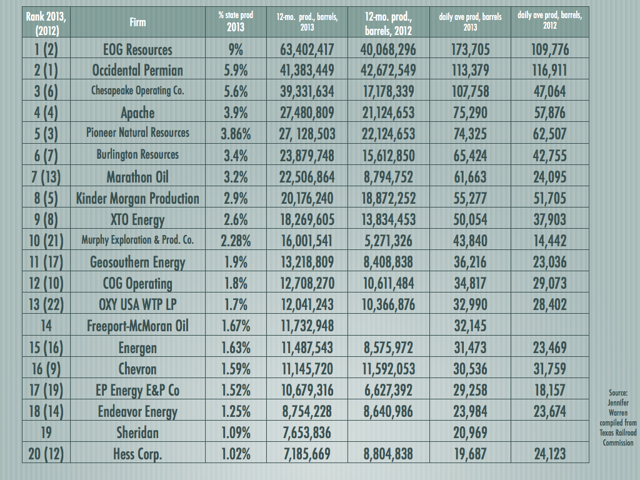

As longer-dated prices rise on intensifying instability in the Middle East—the center of the conventional oil industry—this should benefit firms operating in unconventional areas. Chief among these are North American exploration-and-production companies developing shale resources and the like.

The IEA forecasts global oil demand to rise by 6.58 million barrels a day by 2018, of which 61% is to be met by extra North American supply. That represents a slowdown in output growth. But if Iraqi growth slows sharply, that would raise prices and likely spur even more investment in North American oil. E&P firms rely on the futures market to lock in prices, providing certainty on cash flow to underpin drilling. So any rise in longer-dated oil futures would reinforce this.

Ultimately, though, all this is bearish for oil longer term. Iraq joins a litany of countries such as Libya, Nigeria and Venezuela—all OPEC members—that can't necessarily be relied upon as stable suppliers.

The high prices and geopolitical shocks that ensue are slowly but surely pushing oil consumers to redouble efforts to reduce demand. They also are raising the energy burden on vulnerable regions such as the euro zone, slowing economic growth that underpins the oil market's health. The Middle East's periodic conflagrations, so often lighting a fire under oil markets, eventually will burn them down.