iMFdirect

The International Monetary Fund's global economy forum

House prices are inching up. But is this a cause for much cheer? Or are we watching the same movie again? Recall how after a decade-long boom, house prices started to fall in 2006, first in the United States and then elsewhere, contributing to the 2008-9 global financial crisis. In fact, our research indicates that boom-bust patterns in house prices preceded more than two-thirds of the recent 50 systemic banking crises.

The International Monetary Fund's global economy forum

House prices are inching up. But is this a cause for much cheer? Or are we watching the same movie again? Recall how after a decade-long boom, house prices started to fall in 2006, first in the United States and then elsewhere, contributing to the 2008-9 global financial crisis. In fact, our research indicates that boom-bust patterns in house prices preceded more than two-thirds of the recent 50 systemic banking crises.

Detecting overvaluation more art than science

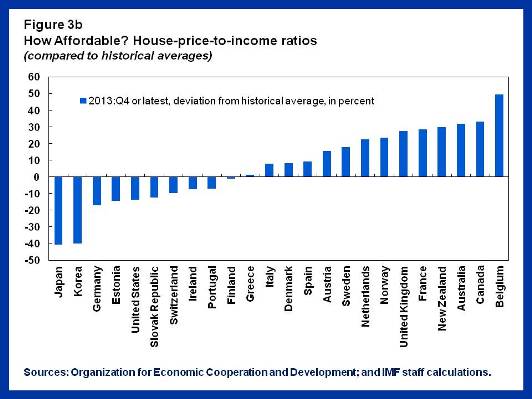

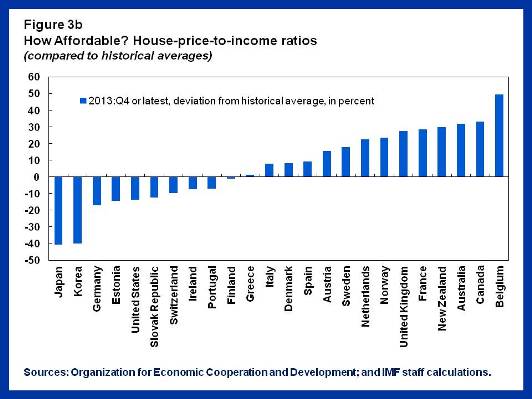

The evidence on house price-to-rent and house price-to-income ratios, however, provides only a broad indication of housing market valuations. Judgments about housing valuation also require supplementary information, such as credit growth, household indebtedness, lender characteristics, and the method of financing.

As part of its regular reports on economic conditions in countries—the so-called Article IV reports—IMF country teams often provide an assessment of housing markets, and are increasingly paying attention to credit growth, along with several other country-specific features of the housing market. In some cases, this more detailed look suggests much more modest overvaluation than indicated by the house price to income and house price to rent ratios. One example of this is Belgium, where the IMF concluded that despite the high valuation ratios, risks of a sharp correction of real estate prices appear contained. These country-specific factors for housing cycles suggest that the policy response cannot be ‘one size fits all’.

While a recovery in the housing market (Figure 1) is surely a welcome development, we need to guard against another unsustainable boom. Housing is an essential sector of every country’s economy and has systemic implications, which is why we at the IMF are focusing on it not only in individual countries but on a cross-country basis.

But the task is difficult for a couple of reasons. First, assessing when house prices are out of line with economic fundamentals is as much art as science. Second, the policy toolkit to manage housing cycles is still under construction.

Determining a fair price

Over the past year, 33 out of 52 countries in our Global House Price Index showed increases in house prices (Figure 2). Are these changes moving house prices closer to or further away from economic fundamentals?

Over the past year, 33 out of 52 countries in our Global House Price Index showed increases in house prices (Figure 2). Are these changes moving house prices closer to or further away from economic fundamentals?

Theory asserts that house prices, rents, and incomes should move in tandem over the long run. If house prices and rents get way out of line, people would switch between buying and renting, eventually bringing the two in alignment. Similarly, in the long run, the price of houses cannot stray too far from people’s ability to afford them––that is, from their income. The ratios of house prices to rents and incomes are thus often used as an initial check on whether house prices are out of line with economic fundamentals.

What does the evidence show? For the Organization for Economic Cooperation and Development countries, where a sufficiently long time-series of house prices, rents and incomes is available, these ratios remain well above the historical averages for a majority of countries. This is true for instance for Australia, Belgium, Canada, Norway and Sweden (Figures 3a and 3b).

Detecting overvaluation more art than science

The evidence on house price-to-rent and house price-to-income ratios, however, provides only a broad indication of housing market valuations. Judgments about housing valuation also require supplementary information, such as credit growth, household indebtedness, lender characteristics, and the method of financing.

As part of its regular reports on economic conditions in countries—the so-called Article IV reports—IMF country teams often provide an assessment of housing markets, and are increasingly paying attention to credit growth, along with several other country-specific features of the housing market. In some cases, this more detailed look suggests much more modest overvaluation than indicated by the house price to income and house price to rent ratios. One example of this is Belgium, where the IMF concluded that despite the high valuation ratios, risks of a sharp correction of real estate prices appear contained. These country-specific factors for housing cycles suggest that the policy response cannot be ‘one size fits all’.