It's that time of year again. We are just a couple of days away from Apple (AAPL) releasing its quarterly earnings report, which will be its fiscal first quarter. Apple will report after the close on Monday, January 27th. Each quarter, I provide an extremely detailed preview of Apple's completed quarter and a brief discussion of the quarter to come. Each time around, I try to highlight one central theme as the key for both the reported quarter and the one Apple will be providing guidance to. It may not be much of a surprise, but the most important part this time around is China, and not just because of the China Mobile (CHL) deal. Today, I'll preview Apple's fiscal first quarter and look forward to the second quarter as well.

Looking at past results:

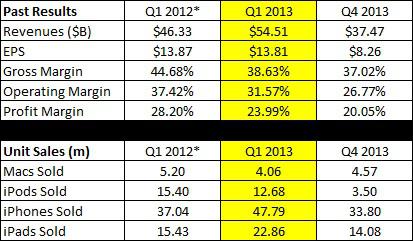

Before I get into the current quarter, it's always good to look back at past results. The table below shows fiscal Q1 in the last two years, with last year's Q1 period in yellow. I also included last fiscal year's Q4, so you can get an idea of how things are sequentially.

*14-week period. Results not adjusted for extra week in quarter.

Back in October when Apple reported fiscal fourth quarter results, the company gave the following guidance for fiscal Q1:

- revenue between $55 billion and $58 billion.

- gross margin between 36.5 percent and 37.5 percent.

- operating expenses between $4.4 billion and $4.5 billion.

- other income/(expense) of $200 million.

- tax rate of 26.25 percent.

This is Apple's biggest quarter of the year, and most likely, the Q1 report will show an all-time quarterly sales record for Apple. I mentioned in my opening that China was a key. In 2013, when Apple released the iPhone 5C and 5S, the phone was available in China the same day it was available in the United States. In the past, there has been a multi-week or multi-month wait for the phone in China. The availability of the phone earlier than in the past has pushed a bunch of sales into fiscal Q1, and remember, this was all before the China Mobile deal. More on that later in the Q2 guidance section. In the next few sections, I'll take a look at each product category individually, and discuss the important items to consider in terms of Apple's earnings.

Product overview - the iPhone:

It's going to be a monster quarter for the iPhone, and that makes sense. Apple released two separate versions of the phone, the 5C and 5S in September, but fiscal Q1 (a holiday quarter) is the first full selling quarter for the phone. As I mentioned above, the phone went on sale in China much earlier. Even though there was no China Mobile deal in place for Q1, China sales are expected to be very strong.

Current estimates for the iPhone call for sales of 55.3 million units in Q1. That would represent a 16% or so increase over last year's period, which was a little under 48 million. The link above is from Philip Elmer-Dewitt, who covers Apple for Forbes. At the moment, the iPhone and iPad are the only product categories for which he has a collection of analyst estimates, but as we get closer to earnings, you should probably check his site for other estimates as well.

There are two important items to consider when it comes to the iPhone, outside of total units sold. First, the mix of sales between the 5S, 5C, and other models will have a large say as to the average selling price for the iPhone line. A dollar or two here or there doesn't normally seem like much, but when you are talking about 55 million units or so, it's a big deal. The difference between $575 and $580 per phone, for example, could be as much as $300 million in total revenues if Apple came in at 60 million units. A dollar or two on the iPhone selling price could be the difference between Apple making and missing revenue estimates for the quarter.

The second item to consider is the percentage of Apple's total revenues that come from the phone. The iPhone will probably represent about 55% or so of Apple's total revenues this quarter. With the iPhone being a higher margin product than the iPad, for instance, a higher mix of iPhones versus iPads could really help gross margins. More on Apple's overall margins in a bit.

Product overview - the iPad:

Back in October, Apple launched a new version of its premium tablet, the iPad Air, along with a retina display iPad mini. Like the iPhone, the new iPads contained the 64-bit A7 CPU, which was a game changer at the time. Earlycommentary from the sell-side was positive, with the main argument being the higher quality new iPads could lead to a rise in average selling prices for the device.

Apple did not refresh the iPad early in 2013 like the company did in 2012, so this was a major launch, and that should mean pretty high demand. The retina mini iPad was supply constrained, so that could impact sales a little. Overall, it should be a strong quarter for the iPad, and analyst expectations call for 25.09 million to be sold. That would be a little less than 10% growth over the prior year period.

Product overview - the Mac:

The PC industry has been tough in recent years, and Apple is partially to blame for that with the introduction of the iPad. Tablets have taken away plenty of PC sales, but the PC industry decline seemed to improve a bit in calendar Q4. When it comes to the Mac, there are conflicting stories when it comes to US sales.

Gartner and IDC have provided very different figures for Q4 U.S. Mac sales, which benefited from a MacBook/iMac refresh. Gartner thinks they rose 28% Y/Y to 2.2M, leaving Apple with a 13.7% U.S. PC share (+380 bps Y/Y). But IDC thinks they fell 3%, and assigns Apple a 10.9% U.S. PC share (flat Y/Y).

Apple sold just over 4 million Macs in the year ago period, and I think that the company will do a bit better this year. If Gartner is right, Apple could potentially get back towards the 4.5 million unit sales level. I don't think Apple will be close to 5 million, but we shall see.

Product overview - the iPod and other revenues:

The iPod was once the bread and butter device for Apple. Those days are long gone. As was the case in recent quarters, the iPod will probably show a double digit decline in sales, perhaps even a 20% decline or more. My projections have the iPod representing less than 2.6% of Apple's revenues in the quarter.

Apple has some significant other revenues that I must detail as well. These are revenues generated from the iTunes store, as well as device accessories, etc. In last year's Q1, these other revenues were more than $5.5 billion, and they've been growing at a tremendous pace. App store sales topped $10 billion in 2013, with more than $1 billion in December alone. Apple's other revenues might not seem like much, but they could total as much as the Mac and iPod lines combined.

Quarterly gross margin analysis:

As I mentioned above, the sales mix for Apple will be key in determining Apple's margins for the quarter. Additionally, Apple's decision on the price point of the 5C, which I defended, should help margins a little. Those that complained about the 5C's high price also were complaining about weak margins for Apple. Apple used the 5C to defend its margin position, and I applauded the company for that. Also, Apple's margin guidance was a little light when Apple handed in the forecast due to nearly $1 billion in deferred hardware revenues pushed into Q1. With such a high percentage of Apple's sales coming from the iPhone, perhaps up to 60%, I do think Apple will be towards the higher end of its margin guidance.

Q1 estimates and my predictions:

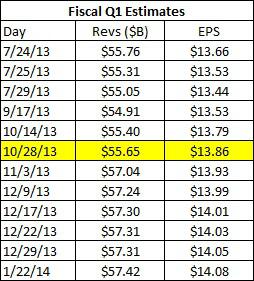

Until Apple launched the new set of phones, analysts were actually cutting their Q1 estimates when it came to Apple. Once the new iPhones were launches, Q1 estimates started to rise a bit. Analysts started to get really positive in late November and December, but the overall tone calmed down a bit when a China Mobile deal was not reached when originally expected. The following table shows how Q1 estimates have trended since July. The yellow line is the day when Apple reported fiscal Q4 results and gave guidance for fiscal Q1.

As a reminder, these estimates are as of Wednesday. We still have a few days until Apple reports, so these estimates could easily change before then. I always get asked for my predictions, so here is what I believe Apple will report for the quarter.

- Revenues of $57.63 billion.

- Net income just under $12.8 billion. EPS of $14.28.

- Gross margins of 37.40%.

- Product sales - Mac sales of 4.50 million, iPod sales of 9.40 million, iPhone sales of 56.40 million, and iPad sales of 25.20 million.

Right now, I'm a little ahead of analyst expectations for revenues, and a bit further ahead for EPS. I do think it will be a strong quarter for Apple, although I'm not going to go above the top end of Apple's revenue guidance. My numbers, like many analysts, would have been a bit higher had a China Mobile deal started in December.

Looking forward to fiscal Q2:

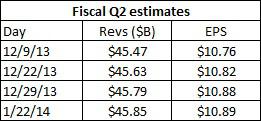

When Apple reports on Monday, the company will give guidance for fiscal Q2. Apple has been giving more realistic guidance in the past year or so, and thus analysts have been able to estimate results a bit better. The following table shows how Q2 estimates have trended since early December.

In the prior year period, Apple reported revenues of $43.60 billion and earnings per share of $10.09. The current revenue estimate calls for 5.2% revenue growth over the prior year period. Obviously, investors are looking for the impact of the China Mobile deal in this guidance. However, investors must remember a key point from Q1. The other Chinese carriers got the iPhone a lot earlier in 2013 than normal, so a lot of sales were pushed into fiscal Q1. I wouldn't be surprised if Apple's guidance falls in the $43 billion to $47 billion range for revenues. I'm being a bit broad there, as I expect the company's actual guidance to be a range of $2 billion or $3 billion. I wouldn't be surprised if guidance looks a little light at first blush, as we are only days removed from the launch of the iPhone for China Mobile. Had we been a month or so into actual sales, guidance probably would be a bit more precise, but for now, I wouldn't be surprised if the range is a little wider and a little more conservative than many expect. Apple usually goes to the slightly conservative side, and I'm hoping that the bear camp does not come out in full force if Apple is a little bit under what most are looking for.

An update on short interest:

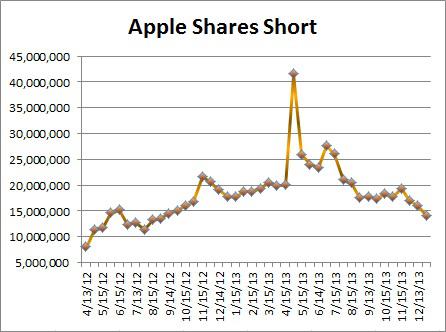

One important item to note outside of the earnings report is that Apple's short interest has been steadily declining for several months now. As you can see from the chart below, Apple's short interest ended 2013 at just over 14.15 million shares. That's down nearly 66% from the high in April 2013, which was over 41.5 million. This is the lowest Apple's short interest has been since September 2012.

There will be one more "update" on short interest with a date prior to Apple's earnings. The next short interest update is based on a settlement date of January 15th. However, because these updates are delayed, we won't see the data until January 27th. We'll get the short interest updates within minutes of Apple's earnings report, but unfortunately, the update will be too late to discuss pre-earnings.

Balance sheet / more Icahn:

Apple ended fiscal Q4 with a little under $147 billion in cash and investments, known as Apple's cash pile, or cash hoard. Of that money, only a little more than $35 billion was located inside the United States. Only US funds can be used for dividends and buybacks, which is why Apple launched a massive debt offering in 2013 to accelerate part of its buyback. You can see my latest post on the dividend and buyback here. My expectation is that Apple's cash pile will have risen above $150 billion during fiscal Q1, but that depends on how much stock was bought back. I also expect that the percentage of funds located outside the US will continue to rise.

Apple is still going to buy back a massive amount of shares in the next two years. However, Carl Icahn is arguing for more buybacks, and he pushed the button again recently. Icahn has been arguing for about $50 billion in share repurchases during the fiscal year, which will probably be about 2 or 3 times what Apple is expected to buy back under the current plan during the fiscal year. Apple will update investors sometime in early 2014 if there will be any changes to the current capital return plan, but I think investors should be fine with the status quo. $100 billion in capital returns over a three year plus period is a tremendous amount. I think Apple will raise the dividend nicely in 2014, and I'll be looking for a new buyback once the current plan ends. However, I wouldn't go overboard, cause Apple would either need to borrow more funds for additional buybacks, or repatriate foreign funds and pay taxes. Neither of those seem very appetizing at the moment.

Where Apple stands now:

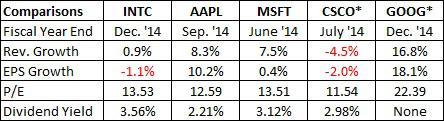

In the end, Apple's stock will react to the earnings, whether they are good or bad. Right now, Apple seems like a decent long term investment, because the company offers a solid combination of growth and value. In the following table, I've compared Apple against some other top tier tech names: Google (GOOG), Microsoft (MSFT), Intel (INTC), and Cisco Systems (CSCO). Yes, there are plenty of other names you could use as comparisons, but I've used these four tech heavyweights in the past, so let's be consistent.

Source: Seeking Alpha. Article by Bill Maurer